-

Posts

2,685 -

Joined

-

Last visited

Everything posted by roger7

-

The Natco results are posted in BSE Site.. Wait till it reaches 915- for adding or making an exit, in near term it will reach 1075(by March'24), 1200 it will take some more time.. but for next three quarters company will deliver Net profit a minimum of 375crs +/- 4-5% for each quarter

-

Natco- (Danchikottadu results tho)scrip crossed 908 mark today for moment and settled at 900level.. For Q3 -Dec quarter the company announced a result of Rs. 212.8crs as PAT... stellar performance with out contribution from G-Revlimid sales for great extent

-

good for day trading for few more sessions-HDFC Bank

-

currently avantel is trading at 106 levels..

-

With this news Laurus has seen day high upto rs. 404 today and now trading at rs. 393 level. In next one quarter irrespective of subsequent results -Laurus will touch -450 rupees making it 1year high after a long time. to the information i have cultured meat division is going to post very positive news by Oct' this year

-

As everybody knows that Laurus Labs is the Angel Investor - in The Research Based firm called Immuno-Act, this Firms CART cell therapy has yielded very good results on their first patient on commercial scale

-

Abbot India will be the India's first ever pharma stock which will surely breach 40k levels in next 1.5year and it will hit 50k definitely

-

Lakshmi machine works and abbott india will be very good why to wait for mrf to go for split..

-

Adding to the above I am expecting stock reach- 350levels from current price in 18months time..and in long run - a period of 48months this stock will be in a position to trade at rs.2500levels if every other parameter of the market is good ...

-

The only issue i see is this company's management doesnt expose themselves at required places and they keep mum in several occasions and keep working.. in today's world marketing is more important thing.

-

They will close the development project of 70,000 sft in Tukkuguda near Hyderabad by May'24.. They are enhancing -Technical and assembling facilities in Gabheeram site(near vizag)

-

Avantel is a stock to buy one more time if it is available between 95- 115 at every dip... I feel they are going to make remarkable impression in below listed technologies, 1.Software defined radios 2. HF Communications 3. Embedded systems and Digital signal processing

-

wait for results i am doing the same...

-

When you compare with it's peers Avantel looks to be expensive player at the same time when you compare it with its peers on financial performance front it looks to be very good.. one more obseravation is that it's EPS is way more higher than its PE... at the same time PE is very decent at 47... from recent results it is understood that they are trying to pave ways into Healthcare/Pharma also.. but contribution from that vertical is minimal till now..

-

3M PRICE CHART MARKET CAP (CR) LTP LAST TRADED PRICE DAY HIGH LOW (%) WEEK HIGH LOW (%) MONTH HIGH LOW (%) QTR HIGH LOW (%) 1 YEAR HIGH LOW (%) 3 YEAR HIGH LOW (%) 5 YEAR HIGH LOW (%) 10 YEAR HIGH LOW (%) GTL Infrastructure Ltd. 3,201.8 2.5 L 4.2%H 2.52.5 L 28.2%H 22.5 L 51.5%H 1.62.5 L 117.4%H 12.5 L 163.2%H 0.62.5 L 127.3%H 0.64.1 L 163.2%H 0.24.1 L 47.1%H 0.28.7 MRO-TEK Realty Ltd. 142.8 76.4 L -5.6%H 75.181.4 L 20.5%H 63.494.7 L 11.8%H 58.494.7 L 31.7%H 55.694.7 L 19.5%H 50.794.7 L 146.1%H 22.194.7 L 107.9%H 14.494.7 L 1676.7%H 3.994.7 Shyam Telecom Ltd. 13.5 12 L -2.8%H 1212.4 L 18.8%H 10.212.4 L 21.8%H 9.612.4 L 50%H 7.312.4 L 36.4%H 6.312.4 L 96.7%H 5.517.9 L 106.9%H 4.717.9 L -51.9%H 4.751.6 Safa Systems & Technologie... 20.4 13.6 L 5.0%H 13.613.6 L 15.3%H 11.713.6 L 5.0%H 11.716.5 L 4.2%H 11.316.5 L 48.6%H 6.218.8 L H 6.218.8 L H 6.218.8 L H 6.218.8 Telogica Ltd. 19.1 8.0 L 5%H 8.08.0 L 5%H 7.68.0 L 10.2%H 7.68.0 L 15.7%H 6.98.0 L 54.1%H 5.28.0 L 191.2%H 1.48.0 L 235.3%H 0.98.0 L 167.8%H 0.912.8 ADC India Communications Ltd. 469.2 1,020.1 L 1%H 1017.91069 L 3.8%H 9751125 L 2.1%H 927.91125 L 13.4%H 8491125 L 99.4%H 4621125 L 421.1%H 1771125 L 410.3%H 105.11125 L 631.2%H 105.11125 Punjab Communications Ltd. 67.6 56.2 L -1.9%H 53.060 L 0.8%H 53.062.5 L 16.1%H 4769 L 46.0%H 36.169 L 75.9%H 25.169 L 147.5%H 17.669 L 156.6%H 969 L -35.3%H 9144.9 Kore Digital Ltd. 369.6 1,050 L 0.5%H 1010.11050 L -0.1%H 1010.11216.2 L 54.1%H 715.61216.2 L 226.1%H 310.01216.2 L 483.3%H 123.31216.2 L 483.3%H 123.31216.2 L 483.3%H 123.31216.2 L 483.3%H 123.31216.2 Valiant Communications Ltd. 284.3 393.6 L 5.0%H 386393.6 L -1.4%H 368.1439.7 L 29.4%H 292.6439.7 L 34.8%H 281.5439.7 L 162.4%H 111.3439.7 L 443.3%H 43.4439.7 L 1493.5%H 14.2439.7 L 2713.4%H 12.0439.7 Avantel Ltd. 2,725.8 112.1 L -1.2%H 112116 L -3.6%H 110.7119.9 L -1.0%H 110.7140 L 10.5%H 101.7140 L 320.0%H 24.2140 L 1608.1%H 6.0140 L 2953.1%H 2.3140 L 14840%H 0.7140 Kavveri Telecom Products Ltd. 33.2 16.5 L -1.8%H 16.516.5 L -6.3%H 16.518.0 L 11.1%H 13.618.0 L 52.8%H 10.618.0 L 153.9%H 4.418.0 L 900%H 1.718.3 L 182.1%H 1.718.3 L -45.3%H 1.729.5 Optiemus Infracom Ltd. 2,434.1 283.5 L -4.4%H 282.6298.1 L -8.2%H 282.6318 L -9.2%H 282.6319 L -9.2%H 282.6359.3 L -3.9%H 160.3381.5 L 235.9%H 82.8437 L 158.2%H 14.4437 L 352.9%H 14.4437 ITI Ltd. 29,311.9 305.1 L -6.9%H 304329.4 L -10.8%H 304366 L -0.8%H 302.2384.3 L 16.6%H 257.1384.3 L 204.4%H 86.6384.3 L 142.1%H 81384.3 L 217.9%H 44.8384.3 L 1913.5%H 14.9384.3 Frog Cellsat Ltd. 276.7 179.3 L -1.8%H 178.2186.4 L -13.3%H 175.1196.5 L 0.7%H 175.1216.3 L -21.2%H 168.1232 L -12.3%H 137.3311.6 L 75.7%H 137.3311.6 L 75.7%H 137.3311.6 L 75.7%H 137.3311.6 STOCK NAME GTL Infrastructure Ltd. MRO-TEK Realty Ltd. Shyam Telecom Ltd. Safa Systems & Technologie... Telogica Ltd. ADC India Communications Ltd. Punjab Communications Ltd. Kore Digital Ltd. Valiant Communications Ltd. Avantel Ltd. Kavveri Telecom Products Ltd. Optiemus Infracom Ltd. ITI Ltd. Frog Cellsat Ltd.

-

Next dividend announcement will be in June-July 2024 and I am expecting it to be around 3rupees are so..

-

Above clipped are the results of Avantel Limited - for last 11 quarters.. Currently the stock is trading at Rs.113 rupees and March '24 results will be above average- expecting a sliding down in stock price to the level of Rs. 99- Rs. 105.. The below is the sharing holding pattern over a period of time... where-in Public stake is high... Summary Dec 2023 Sep 2023 Jun 2023 Mar 2023 Dec 2022 Sep 2022 Jun 2022 Mar 2022 Dec 2021 Sep 2021 Jun 2021 Mar 2021 Promoter 40.1% 40.1% 40.1% 40.1% 40.1% 40.1% 40.1% 40.1% 40.1% 40.1% 40.4% 40.4% FII 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% DII 0.0% 0.0% 0.0% 0% 0% 0% 0% 0% 0% 0.4% 0% 0% Public 59.9% 59.9% 59.9% 59.9% 59.9% 59.9% 59.9% 59.9% 59.9% 59.5% 59.6% 59.6% Others 0% 0% 0% 0% 0% 0% 0% 0% 0% 0.0% 0% 0%

-

Indicator Graph Dec '23 Sep '23 Jun '23 Mar '23 Dec '22 Sep '22 Jun '22 Mar '22 Dec '21 Sep '21 Jun '21 Total Revenue 59.7 54.7 69.2 52.6 39 36.3 27.1 47.2 29.2 15.8 14 Operating Expenses 34.9 29.4 54.7 34.4 27.5 26.2 19.6 37.7 21.2 10.4 9.1 Operating Profit 24.4 25 14.3 18.1 11.2 10 7.4 9 7.9 5.1 4.7 Operating Profit Margin % 41.20% 45.93% 20.67% 34.52% 28.94% 27.71% 27.31% 19.36% 27.09% 32.74% 33.97% Depreciation 1.8 1.6 1.6 1.5 1.5 1.4 1.4 1.2 1 1 0.9 Interest 0.9 1.5 1.5 1.5 1.5 1.1 0.7 0.4 0.4 0.3 0.3 Profit Before Tax 22.1 22.2 11.4 15.2 8.4 7.6 5.5 8 6.6 4.2 3.7 Tax 5.8 6.1 3.4 5.5 1.7 1.5 1.1 1.9 1.2 0.7 0.7 Net Profit 16.3 16.1 8 9.7 6.7 6.1 4.4 6.1 5.4 3.4 3.1 Basic EPS 0.7 2 4.9 6 4.1 3.8 2.7 15 13.3 8.5 1.9 Net profit TTM 50.1 40.5 30.5 26.9 23.3 22 19.3 18 17.6 Basic EPS TTM 2.1 5 18.8 16.6 14.4 13.6 11.9 44.3 43.4

-

the above is the projection for FY'25... post MCP meeting, this is for GDP

-

Impact As RBI’s policy statement was broadly in line with market expectations, 10Y yield is currently trading at 7.08%. Governor again reiterated that the Central Bank is focused on bringing inflation back to 4% level on a durable basis and any change in stance should be looked at from the point of view of inflation and “incomplete transmission” of rates. On the liquidity front, RBI noted that “adjusted for government cash balances, potential liquidity in the banking system is still in surplus”. Further, Governor clarified that liquidity conditions are “being driven by exogenous factors” and RBI’s stance should not be linked with this. To “correct” liquidity conditions, RBI will continue with its “market operations”. For instance, with government spending again picking up pace, RBI conducted VRRR auctions between Feb 2-7 to absorb surplus liquidity. Going forward, RBI will “deploy an appropriate mix of instruments to modulate both frictional and durable liquidity”. We believe that RBI’s upward revision to GDP projection for FY25 (7%) is slightly more on the optimistic side and we maintain that growth will most likely fall in the 6.75-6.8% bracket. We remain cautious on account of domestic agriculture growth and possible impact of geopolitical tensions hampering global supply chains. In addition, expected slowdown in global economy, due to increased chances of ‘soft landing’ of the US economy, continued weakness in Eurozone and China’s economy, along with uncertainty in the timing of Fed rate cuts, may also hurt external demand. We await more information on monsoon forecasts for this year to gauge the impact on GDP. We expect inflation to swing between 4.5-4.75% in FY25, broadly in line with RBI’s 4.5% inflation forecast. As pointed out by the central bank, we also believe that upside pressures can emerge from volatility in global commodity prices, in particular international crude oil prices. Any deviation from normal monsoon can also have an impact on domestic food prices.

-

Inflation projections lowered: For FY24, RBI has retained its projection at 5.4%, however it has lowered Q4FY24 estimate from 5.2% (Dec’23 policy) to 5%. For FY25, the Central Bank expects inflation to come in at 4.5%, with Q1 at 5% (5.2% as per Dec’23 policy), Q2 at 4% (unchanged from Dec’23), Q3 at 4.6% (4.7% earlier) and Q4 at 4.7%. The downward revisions have been made as RBI remains confident that Rabi sowing has been satisfactory this season, and vegetable prices are also on a downward trajectory now. Further, these numbers are also based on the assumption of normal monsoon in FY25. Upside risks to these forecasts may emerge on account of volatility in international commodity price and in particular oil prices. Ongoing geopolitical tensions may impact supply chains, which could in turn have impact on global commodity prices.

-

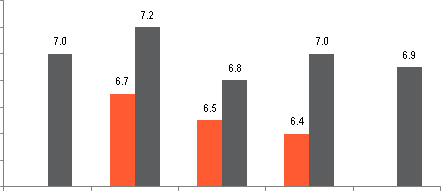

GDP growth: Following 7.3% growth in FY24 (as per NSO’s advanced estimates), RBI expects 7% growth in FY25. Quarterly projections have also been revised upward, with growth in Q1 now estimated at 7.2% (versus 6.7% in Dec’23 policy), Q2 at 6.8% (6.5% earlier), Q3 at 7% (6.4% earlier) and Q4 at 6.9%. Robust growth in FY25 predicted on the back of: resilience shown in services activity, continued profitability of the manufacturing sector, likelihood of increased consumption demand, steady Rabi sowing, and government retaining focus on capital expenditure. Downside risks may emerge from escalation of geopolitical tensions and volatility in international financial markets. We believe RBI’s FY25 growth projection to be slightly more optimistic and retain our estimates at 6.75- 6.8%.

-

No change in policy: In line with our expectation, RBI decided to remain on hold, thus keeping the repo rate unchanged at 6.5%. Subsequently, SDF rate remains at 6.25% and MSF and Bank rate at 6.75%. Stance was also retained at “withdrawal of accommodation”. However, both decisions were not unanimous and were passed with 5-1 vote. Amongst MPC members, Prof Jayanth R. Varma voted for 25bps cut in policy rate and change in stance to “neutral”. Governor Das highlighted that RBI’s stance “should be seen in the context of incomplete transmission and inflation ruling above the target of 4% and our efforts to bring it back to the target on a durable basis”. We thus expect earliest possible change in RBI’s position only in Jun’24, that too if inflation falls significantly below RBI’s expectations. If inflation follows RBI’s trajectory then no change in position can be expected before Aug’24.

-

RBI remains on hold MPC members for the 6th consecutive time kept policy rates on hold, by keeping repo rate unchanged at 6.5%, SDF at 6.25% and MSF and bank rate at 6.75%. RBI also left its stance of “withdrawal of accommodation” unchanged. However these decisions were not unanimous, and were passed with the vote of 5-1. Central bank highlighted that interest rate transmissions are still not complete and inflation is yet to be brought down to targeted level on a durable basis. Hence, RBI’s stance should be viewed in this context, and “mix of instruments” will be used by the Central Bank to manage the liquidity situation. RBI expects GDP growth to remain at solid 7% in FY25, supported by government capex, domestic consumption and corporate profits. Inflation is projected to come down to 4.5% in FY25 from 5.4% in FY24, due to satisfactory Rabi sowing, dip in vegetable prices and expectation of a normal monsoon in FY25. We foresee no change in RBI’s position before Aug’24. However, in case inflation surprises on the downside, then a tweak may be expected in Jun’24 policy.